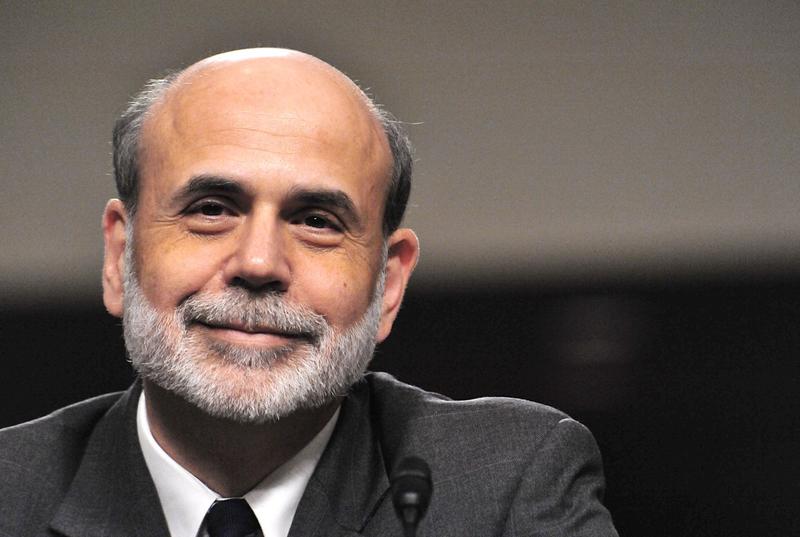

Welcome to Politics Bites, where every afternoon at It's A Free Country, we bring you the unmissable quotes from the morning's political conversations on WNYC. Today on the Brian Lehrer Show, David Leonhardt, writer of the "Economic Scene" column for the New York Times, discusses yesterday's first-ever press conference by Fed Chairman Ben Bernanke.

Two top US government officials made big appearances yesterday, President Obama with his birth certificate and Federal Reserve Board Chairman Ben Bernanke on inflation and jobs, in the first ever press conference by a Federal Reserve Chairman.

The New York Times’ "Economic Scene" columnist David Leonhardt wrote yesterday that he had one burning question for the Fed chairman: Why does Bernanke accept continuing widespread unemployment? Leonhardt believes Bernanke has the power to do something about the situation. During the press conference Bernanke — sort of — answered Leonhardt’s burning question, by denying that he has the power to address long-term unemployment, and instead could only try to improve the labor market in the hopes that the long-term unemployed will benefit. Leonhardt was dissatisfied with Bernanke’s response that the Fed has already done a lot, and if more is done it would risk rising inflation, which could hurt employment further.

I think there’s a lot about Bernanke’s performance yesterday that was impressive, I think there’s a lot about him that is impressive, but I didn’t think those were very good answers.

Too Much, or Too Little?

Bernanke has repeatedly said that even when the Feds benchmark interest rate (which affect short-term interest rates) is at zero, it retains the power to lift growth and employment. Even at yesterday’s press conference he said that good monetary policy has the power to affect the speed of recovery following a financial crisis. But Leonhardt said Bernanke has been unwilling to do more to reduce unemployment.

He is essentially looking at a situation in which but remains very low historically, and unemployment remains very high, historically, and he’s saying that inflation and unemployment are roughly equal-sized problems right now and I just don’t think that’s right.

Conservative economists have been taking an opposite tack from Leonhardt’s, voicing their concerns that Bernanke is doing too much with quantitative easing, and that the increase in currency could bring inflation or depress the dollar. Leonhardt thinks the potential dangers of these interventions are being overblown.

Buying more treasuries is just a way to try to reduce long-term interest rates, as he has pointed out. It’s really not that much different from what the Fed normally does — the Fed usually tries to reduce short-term interest rates. But once it has short-term interest rate is down to zero it obviously can’t reduce them further, so then it tries to reduce long-term interest rates. That’s one thing it could do.

Leonhardt said another thing the Fed could do to help the unemployment situation would be to admit that the economy is in worse shape than they had originally predicted, and freeze short-term interest rates at zero for a set amount of time. In addition he said the Fed could allow inflation is increase a little. Inflation has been so low for so long that it might be okay to have “a period of catch up” in which inflation is a little higher than might be desirable, in order to allow prices to shift to the level they would be, had inflation not been so suppressed.

It is true there are critics who say that they are doing too much. The Wall Street Journal editorial page, Ron Paul, some economists, and they are worried about inflation. I think one thing that’s important to remember is many of those people are always worried about inflation. They were worried about inflation in the middle of last year when they said the Fed is doing too much, it’s going to spark inflation. One Fed official who is in this camp raised the specter of the Weimar Republic. They ended up being entirely wrong. Inflation was not a problem last year, the slowness of the recovery was a problem, and the Fed basically admitted this and admitted that they had done too little.

The Ups and Downs of Low Interest Rates

Bernanke did not address the question of what will happen to seniors on fixed incomes who, because of the low rates, cannot get a good return on a safe investment. Leonhardt thinks that that probably is a consideration for Bernanke, but noted that increased rates almost certainly lead to higher unemployment, which might affect the children of those very same seniors.

[Bernanke] tries to look at what’s going on… and make a decision based on that. So he is not raising rates because the notion that you would begin to raise rates at a time when the economy is as weak as it is now, is incredibly dangerous. It really has the potential to choke off the recovery.

The current QE2 quantitative easing program will expire in June, and it does not appear that there will be a QE3, but neither does it seem that the Fed will raise rates.Leonhardt thinks Bernanke is being too cautious.

The mistake he’s making here is he is, he wants to see himself as both a moderate and an empiricist. And I think in this case he is putting the moderate ahead of the empiricist. I think that if you were to judge the evidence right now you would say that the Fed needs to be doing more.

Bernanke does appear to be responding to political pressure within the Fed.

He has people within the Fed and some of the regional fed banks, who want to start raising rates, who are very concerned about inflation. He is well-aware that he has people on capitol hill who want him to start raising rates, and if he does more to try to boost growth and boost unemployment, he will come under attack from a lot of these people, and that’s where I think he’s trying to stake out this ground as a moderate. He wants to be in between the people who think he should do more and the people who think he should start doing less now. The problem is, I think, that when you look at the numbers on unemployment and inflation, it’s clear to me that he should be doing more.

While the inflation rates of some commodities, such as oil, are determined largely by the demand from emerging commodities other than the US, such as China or India, the Fed still has control over domestically produced and consumed items, such as American-made cars and haircuts. Especially with larger purchases such as cars, which people tend to take out loans to purchase, the Fed’s control of the interest rate can influence sales and affect the economy in the United States. Yet there are limitations in what monetary policy can accomplish. Congress, which sets fiscal policy, could pass temporary tax cuts and spending measures to put people back to work. Leonhardt doesn't see that as likely in the current political climate.

There is no political scenario in which you can imagine the current Congress passing bills to do that. So given that that isn’t going to happen, we are then left to look at the Fed, to say what can the Fed do to help? And the fact that congressional policy, fiscal policy, would be a better way to address this problem doesn’t let Bernanke off the hook, because he only controls one of those two, and the fact is while he can’t make the economy suddenly feel healthy, he could do more than he is currently doing, and he should be doing more than he is currently doing.