The Brian Lehrer Show

The Brian Lehrer Show

Public Service Student Loan Forgiveness: How-To

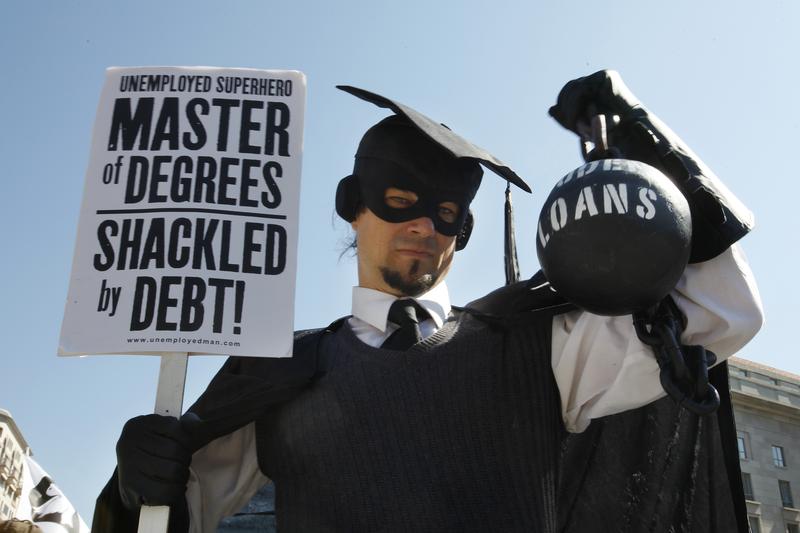

( Jacquelyn Martin) / AP Photo )

The Public Service Loan Forgiveness (PSLF) program offers a chance of debt relief for workers at government and qualifying non-profit organizations. Rich Leimsider, founder and campaign director of PSLF.nyc, a non-profit organization promoting applications to the waiver program, and Sheena Wright, deputy mayor of strategic initiatives for the City of New York, talk about who qualifies and how to apply before the October 31st deadline.

Brigid Bergen: It's The Brian Lehrer Show on WNYC. Welcome back, everybody. I'm Brigid Bergen, WNYC and Gothamist reporter and host of the new Sunday politics show, The People's Guide to Power. President Biden's new student loan forgiveness plan has gotten a lot of attention most recently in anticipation of the GOP legal challenges might soon face, but we're going to talk about an older loan forgiveness program that has an upcoming expiration date.

The Public Service Loan Forgiveness program aimed at providing debt relief for government and non-profit workers like teachers, nurses, social workers, city workers, my public radio colleagues. It was started in 2007, but the way the rules were designed, applicants had less than a 1% success rate. Then last year, the US Department of Education used their COVID-19 emergency powers to create the PSLF waiver.

This temporary waiver essentially means more people are now eligible due to rule changes in expanded eligibility. Listeners, if you've worked in a government or non-profit role and made 120 payments towards your loan during that time, which is essentially about 10 years, you may be eligible to have your debt wiped away. People have to submit their application by October 31st of this year. That's just 26 days from now.

Joining us now is Rich Leimsider, founder and campaign director of PSLF.nyc, a non-profit organization promoting applications to the waiver program, and Sheena Wright, deputy mayor of strategic initiatives for the city of New York, who will help us make sense of these new rules under this temporary waiver and explain to see if you're eligible to apply. Thank you both for joining us and welcome to WNYC.

Rich Leimsider: Good morning, Brigid. Thanks so much. Thanks for a really fantastic introduction. You hit all the points.

[laughter]

Deputy Mayor Sheena Wright: Yes, thanks.

Brigid Bergen: Well, I'm so glad. Listeners, do you work in government or for a non-profit? Do you have questions about the temporary PSLF waiver? Are you unsure if you qualify? Call us at 212-433-WNYC. That's 212-433-9692, or you can tweet @BrianLehrer, or maybe you've already applied and been successful. Call and share your application hacks with us if you have any. That number again, 212-433-WNYC. That's 212-433-9692. Rich, let's start with some basics for those who may not have heard about the country's Public Service Loan Forgiveness program. What kinds of non-profit and government careers count and how much debt forgiveness is provided to those who qualify?

Rich Leimsider: Yes, exactly, Brigid. This is such an exciting opportunity and you really did hit all of the most important key points. This is a 15-year-old program that was a promise to public service workers in the United States dating back to 2007. For 14 years, the promise wasn't kept. It was a law passed with all of the best intentions, really, with the idea that it would be a GI bill. Not quite as good as a GI bill, but a watered-down GI bill that would help government and non-profit employees make it through student debt.

The amazing thing about the program, even from day one, is that the jobs you have with a non-profit or with a government agency doesn't matter. Every single job at any non-profit organization. You can be the head of cardiology at NewYork-Presbyterian Hospital, which is a non-profit organization, or you can work in dining services. You can be the mayor or the deputy mayor of the city of New York, so glad to be here today with the deputy mayor, or you can be a school crossing guard or a teacher.

Even more, I want to highlight for listeners that you don't even have to have finished the academic program. From a racial equity and anti-poverty perspective, one of the biggest opportunities for New Yorkers is that folks that tried a year of higher education took out $15,000 or $20,000 in debt, but never actually got that associate's degree or that nursing degree but, nevertheless, have been working for a non-profit, working for a government agency, are still eligible to get all of their student loans forgiven.

Unlike the recent announcement, as you said, which is going through some legal challenges, the Public Service Loan Forgiveness program eliminates every dollar of remaining student loans. I have a former colleague who just had literally $340,000 worth of student debt. Her entire undergraduate and graduate school debt eliminated under this program.

Brigid Bergen: Wow, that is so dramatic. Deputy Mayor Wright, I know Rich made the point, but maybe you can underscore it, particularly for city workers, the types of city workers this waiver might apply to.

Deputy Mayor Sheena Wright: It's every single person that works for the city of New York. There are over 300,000 employees of the city of New York. As Rich said, everyone from a school safety agent, a teacher, a policy analyst, someone who works for the Department of Sanitation. Every single city worker qualifies for this because you work for the city of New York.

It's really a huge pool of people and we're really trying hard to get the word out and really grateful for programs like this. It is a game-changer. Rich gave one example of somebody that has enormous amount of debt. I went to undergrad and law school was able to get financial aid for undergrad, but not law school. I had to take out six figures of loans. I graduated from law school 28 years ago and I was still paying student loans, right?

This enables even me and it was costing me about $400 a month, which is real money. That's 28 years later. There are people, I think, on average, $64,000, $65,000 worth of debt. It just makes such a huge impact and we want people to get it done. It is not that difficult. There's lots of resources to help you do it. It will really have a significant impact on you and your family.

Brigid Bergen: Rich, we're going to get into some of the specifics of how our listeners can find where they begin this application process and get some help if they need it. I just wonder if you have a sense of, why do you think this program has flown so under the radar?

Rich Leimsider: That's a great question, and it's one that I have a deeply personal experience with. I am not a student loan expert. I'm not a person who's done financial counseling for a career. I worked in the non-profit sector my entire career. Like the deputy mayor, I, 20-plus years after graduate school, was still paying my loans. I woke up on May 11th and discovered that every penny of my remaining student debt had been forgiven under this program.

Because the program was so challenged for the first 14 years, there were a number of bureaucratic obstacles that gave it that 99% rejection rate that you so poignantly referenced. Really, the only thing worse than not knowing about the program was knowing about the program for the first 14 years. We had hundreds of thousands of people who'd had these horrible experiences.

Talking to those folks is the most significant challenge right now because they know what a stinker this program was for 14 years. They can't imagine coming back to try it again. With such a high rejection rate, why would anyone bother to create a national awareness campaign in that original recipe, that first version of the PSLF program? Right now, we've really been trying to overcome those significant reputational obstacles.

Then the second part is the fact of the matter, the specific elements of this program sound a lot like the kind of spam email we get every week in our inboxes, "Special government program can save you $50,000-plus. Click here." I saw that three times last week. As proud as I am of this PSLF.nyc campaign and the incredible partners working with the city, with unions, non-profit organizations, nobody's heard of us.

People really need to hear it from trusted partners. They need to hear it from WNYC. They need to hear it from the city of New York, from their employers, and their unions so that they know this is real, that the deadline is real, the opportunity is real. This is not a made-up thing. This is an incredible, massive opportunity for 250,000 residents of the city of New York alone, $10 billion in wealth that could be transferred to working-class New Yorkers.

Brigid Bergen: Wow. Listeners, do you work in government or non-profits? Do you have questions for my guests, Rich Leimsider, founder and campaign director for PSLF.nyc, that's a non-profit organization promoting applications to this waiver program, and Sheena Wright, deputy mayor of strategic initiatives for the city of New York, about the temporary PSLF waiver, which expires after October 31st? Call us at 212-433-WNYC. That's 212-433-9692, or tweet @BrianLehrer. I want to go to Bridget in North-- Very nice name by the way. East Northport, New York. Bridget, welcome to WNYC.

Bridget: Oh, thank you. It's such a thrill being on. Thank you for taking my call.

Brigid Bergen: What is your question?

Bridget: Well, presently, I'm not working for a non-profit, but I worked for a non-profit for 12 years. During that time, I was making monthly payments. They were being drawn automatically from my bank account, so I easily meet the criteria of the program. I keep getting very confused with the paperwork. It seems that there's sort of two types of student loan forgiveness. They have these acronyms. I can't even keep straight. PSLF and something else. I'm just looking for someone I can trust to help me through the process because I also know that there are-- I fielded calls from people who are not with reputable organizations that are looking for money for this help and give them enough personal information.

Brigid Bergen: Let's try to get you some answers about how to start this process. Rich, can you help our listeners understand what some of these new rules are related to this limited waiver? What would you say to someone like Bridget, who's struggling to figure out where to begin?

Rich Leimsider: This is such an important conversation to have. Thank you, Bridget, for sharing your story because it's a lot like many others. Where I would start is to say, the most important thing is to understand-- I tell folks that this PSLF waiver program, I think of it the way I think of my cell phone. I don't actually know how my cell phone works, but it works for me and it gets the job done.

The good news is, the really important news, is that we can move forward towards loan forgiveness without actually fully understanding all of the legal elements of the program, how things were changed. There are lots of specific changes. This is a truly miracle season where, for example, in the original recipe of the program, you had to be currently working for a qualifying employer on the time that you applied even if you already had 12 years, even if you qualify in every other way. That's not true right now.

Bridget does qualify even though she's not currently working for a non-profit. You had to be making payments for all 10 of those years. Right now, that's not true. You can actually have had an economic hardship deferment or missed a payment here and there. The government's going to still give you credit. The most important thing that Bridget and others can do right now is to visit the federal government's website where they have a Help tool, studentaid.gov/pslf, and just spend 30 minutes working through the Help tool.

Every single person who has student loans ought to go to that website right now and get started. If they get stuck, they can come to us. We have not only explanatory notes, background information, but even referrals where folks can get live one-on-one guidance and counseling after they've tried that Help tool. We are PSLF.nyc. That's the website. The last thing I want to flag is there is a lot of bureaucratic language online. The federal government has not gotten around to updating all of their forms and web pages to reflect this magical waiver period.

There's still a lot of language that reflects the kind of bad old days when nothing could get through. It's very easy to get discouraged. That's why our message really is go to that Help tool, push through, and get your application submitted by the 31st, and kind of ignore the noise. You're even going to get an automatic rejection. People who are submitting applications right now are still getting rejections within the first few months because those old automated systems haven't been turned off, but then the government gets around to reviewing things and moving things forward and making the forgiveness happen.

Deputy Mayor Sheena Wright: I would just also say, and I feel for you, Bridget, because it's a little intimidating to kind of approach this. It feels very complicated, but I just want to underscore what Rich said in terms of just trying to do it and push through. If you get stuck and I was able to get-- we've had webinars and other resources, but Rich's organization will hold your hand and walk you through it. That has been enormously helpful resource that is available.

Brigid Bergen: Let's go to Emy in Brooklyn. Emy, welcome to WNYC.

Emy: Hi, Brigid, thanks for having me on. I wanted to talk about adjunct professors in New York, who are technically part-time, and one of the qualifications for the Public Service Loan Forgiveness program has always been that you need to work a minimum of 35 hours per week. A lot of adjunct professors work this many hours, but our paperwork doesn't document this.

Governor Hochul, a week or two ago, signed a law that makes it-- Basically, for every hour in the classroom, there's 3.3-something hours of prep time that is calculated for adjunct professors in New York State. This makes a lot of adjuncts now eligible for the Public Service Loan Forgiveness, which is a life-changer for people in my situation who teach at public colleges like CUNY.

Brigid Bergen: Emy and Rich jumped in here and Deputy Mayor to sort of build on the point that Emy's making. Just to be clear, we're talking about adjuncts at CUNY, is that correct? It's not necessarily an adjunct at a private university?

Emy: I believe any non-profit university, which includes almost all universities, even private universities within New York State as long as it's not a for-profit school.

Deputy Mayor Sheena Wright: Yes, Columbia, NYU, those are all non-profit institutions, so yes, basically all.

Brigid Bergen: That's a great addition to people who would be covered by this program. Rich, I know this is not something that you have control over, but you made this point talking about this kind of magical period that we're in. Why is it temporary? Why are we only in this temporary period? Why not make these changes permanent to afford people more time to take advantage of this program? What would be the argument since, obviously, you don't have the magical wand to make that change?

Rich Leimsider: I think the argument is a very straightforward one, which is the PSLF program was created by the Higher Education Act in 2007. It was a bipartisan bill. It was signed by George W. Bush. It was written by Ted Kennedy and others. It was a promise to public service workers and it was a promise that was never fulfilled. Because there were these bureaucratic problems, the way the law was written was, unfortunately, much too narrow.

As one example and one of the things that this waiver period fixes, if you didn't know about the program and get your paperwork straight on day one of your qualifying job, that time didn't count towards your 10 years. If you were a New York City public school teacher who didn't learn about this program until your sixth year in the system, the federal government considered you as having done zero years of service. That was one of the biggest tragedies.

Under the HEROES Act at a time when a president has declared a national crisis or a national emergency, the US Department of Education is allowed to change the rules of individual programs without getting any kind of congressional or other approval. That's what the Department of Education did about a year ago. Because their read was that this permission is tied to a state of national emergency, they only did it for a short-term basis and they set it to expire on October 31st.

Whether or not the federal government can consider us still in a period of crisis, whether they choose to extend the waiver even by a month or two to help some people get further in is still an open political question in Washington, DC. Otherwise, without this emergency waiver, the only path to really fix some of those fundamental original flaws is with new congressional legislation. I think there's a lot of concern that in DC right now, the odds of getting a new bill passed that would fix this 2007 program are not great. You're exactly right. That's sort of above my pay grade.

Brigid Bergen: [laughs] Listeners, my guests are Rich Leimsider, founder and campaign director for the PSLF.nyc, a non-profit organization promoting applications to the PSLF waiver program, and Sheena Wright, deputy mayor of strategic initiatives for the city of New York. We're talking about this because this waiver expires on October 31st and we want to help you figure out how to apply if you qualify. The number is 212-433-WNYC. That's 212-433-9692. We want to hear your success stories if you have them. I think that is what Sarah in Brooklyn has for us now. Sarah, welcome to WNYC.

Sarah: Hi, thank you for having me on, and thanks for all you do. I've worked for the DOE in the city of New York since May 2007. I'm a parent coordinator at a public middle school. I learned about the PSLF. When I looked at the parameters, I didn't even bother sending in my application because all the payments that had been made, which were okay with the lender, weren't okay with the program. I just shook my head and moved on.

Then after the most recent presidential election, knowing that student loans were a big point of conversation, I googled what the latest was. I found out that there's an expanded Public Service Loan Forgiveness program. When I called FedLoan at first, I was on hold forever. It was not helpful. When I called MOHELA, who was servicing my loan, the woman I spoke to there was really helpful, and so I powered through. She also told me that the payments that I would have made during the pandemic that I didn't have to make actually counted as payments.

It added to the 120 payments. When I sent everything in, I initially got a letter back saying, "We need your exact start date," [laughs] so I sent them that, and then they sent me a letter saying, "Oh, most of your loans got forgiven. You just have a few more payments." Then on April 1st of this year, I got a letter, no joke, April 1st, saying, "Oh, by the way, no, all of your loans are forgiven." It was $30,000.

Brigid Bergen: Wow, Sarah, thank you so much for calling with that story. I think there was something that you said in there that we really want to underscore, which is you said the period that your payments were on hold still counted towards your payments. Did I hear that correctly?

Sarah: Yes.

Rich Leimsider: That's exactly right.

Sarah: When I got the first letter, I thought, "Okay, well, at least they're giving me some of it forgiven." Then when I got the second letter, it was like, "Okay." They did what your guest said, which was sometimes things were a little slow, and they reviewed it and realized, "Okay, yes, she qualifies for all of it." To reiterate what your guest said, just power through the Help tools and just read them really carefully. Use this organization because it wasn't really something I knew publicly about before. Sorry, I'm not speaking English very well. [laughs]

Brigid Bergen: No, you're great. No, you were great. Sarah, I think your story hopefully will inspire some of our listeners to power through. Thank you so much for calling in. Congratulations on getting $30,000 forgiven even if they mailed you a letter on April 1st, so you thought it might have been a joke, but we're thrilled that that happened for you. I want to go to Kate in Brooklyn who has, I think, a tip for helping some of our listeners maybe find some ways to power through. Kate, welcome to WNYC.

Kate: Hi. Yes, just like your previous caller, I also just recently had $32,000 forgiven after many, many years of assuming I wouldn't have had forgiveness because of some really bad advice from a public loan servicer years ago. I was on the wrong payment plan, but I was able to go back. Thanks, I would say. The best tip I have is joining the PSLF subreddit. I would spend hours on hold. I would email the federal student loan servicer. I never got the answers I wanted.

That community was just so supportive and helpful. Everyone would post their timelines like when their loans were dispersed when they got their trophies, which is like the way that you find out that you've got your 120 payments when their accounts were zeroed out, and then when they got refunds, which is actually what I'm waiting for now. I overpaid about 18 months, so I'm waiting for my checks now, but I would only know that because I was watching Reddit.

Brigid Bergen: Wow. Kate, thanks so much for calling. A great tip there for folks who find the Reddit community to be helpful. Kate certainly did in this. We have a question from Randi in Perth Amboy, New Jersey. Randi, welcome to WNYC.

Randi: Hi, thanks so much for having me and for doing this public service. Are you able to hear me?

Brigid Bergen: Yes, you sound great.

Randi: Oh, okay, wonderful. My question is, I have 138 eligible payments. I have received confirmation from my servicer in a letter that I both have the 120 that are required and that I remain rejected. I got a verbal follow-up with a staff person at my servicer, who informed me that that is the natural step and that there will be an automatic re-review or continual review of my application and that a separate communication will come to say that my loans are actually forgiven. There's nothing additional that I need to do. That came verbally. My question is, is that true?

Brigid Bergen: Randi, thank you so much for calling. Rich, it's great to celebrate the success stories, but we know that there are some people who probably are not finding it an easy road to navigate and may, in fact, be getting some rejections. Is what Randi described what you understand the process to be, that it just automatically becomes re-reviewed?

Rich Leimsider: Unfortunately, yes. The first 14 years of this program, the government was able to approve a grand total of 16,000 loan forgiveness applications. They have already done nearly 200,000 in the past 11 months, which is great. They're getting faster. We hope that they're going to have to review another couple of million over the next month. The company that the federal government has hired to manage this process is a company called MOHELA.

It's actually a semi-government agency, the Missouri Higher Education Loan Assistance company, MOHELA. MOHELA is already saying they're not even going to be able to reply with a confirmation that they got the application for three to four months. They're so overwhelmed with the volume of applications at this point. The great news for the caller is that if they are already seeing confirmation of receipt of the application, of a recognition of a certain number of payments, then they have already met all the requirements for the October 31st deadline.

Therefore, there's a lot of time to worry about whether the government is counting things properly later. There are appeals processes. There's an ombudsperson you can reach out to if you think the government is not giving all the credits that they should. At this point, it is going to take four to six months for that MOHELA company to get around to reviewing everything. For a narrower point, one of the things you don't really need to know, but sometimes it's helpful to hear, the government draws a distinction between eligible months and qualifying months.

They have this whole bizarre definition between what is eligible and what is qualifying. Eligible, for the caller, probably means that they had loans that the government already knows from their own databases, that the loans meet the qualifications, but qualifying means that you had the right type of work. They probably just haven't gotten around to reading all of the forms that the caller has submitted explaining that they worked for a non-profit or a government agency, and so that is a hand review that's going to take them months to do, but my sense is that the caller is actually in a very good place. It's going to take a while though.

Brigid Bergen: I guess, essentially, given the fact that all the paperwork is in and more in this procedural phase, there's not necessarily something to worry about right now. This is still a program that may, in fact, forgive whatever the outstanding debt the caller had. It just might take some time?

Rich Leimsider: That's exactly right. I got my updated application and I'm one of those nerds who heard about this program and jumped right on it back in November of 2021. My loans weren't forgiven until April. That was before anybody had really heard about it and it took them five months to get it done. It is unfortunately going to take some time. As long as the applications are in by October 31st-- and thank you so much, Brigid, for continually highlighting that deadline. As long as the applications are submitted within the next, what do we have, 26 days, you're going to be fine. You're going to hold your place in line and things will work out.

Brigid Bergen: Rich, remind us, where do we find this application? Let's just say that one more time so folks can go and start the process. Where can folks find help if they're struggling with completing it?

Rich Leimsider: Delighted to. Our campaign is really highlighting two action items. Right now, every single public service worker who has student loans should go to the federal government's PSLF Help tool. Don't overthink it. Don't try to come up with reasons why you might not qualify. There is no downside to starting with this Help tool and actually getting detailed information from the government.

It's not worth missing out on $20,000, $50,000, $100,000 because you've heard you might not qualify. Everyone needs to get to studentaid.gov/pslf and spend the 20 to 30 minutes working through, powering through that Help tool for the program. Studentaid.gov/pslf. If you get stuck, I want you to come and visit us at PSLF.nyc. We've got online tools and resources. We've got regular live webinars where you can come, learn more, ask questions, and we've got partners that are offering one-on-one counseling and support.

The second big thing I want to highlight for listeners, Brigid, because this is such a terrific audience is if you are in leadership at a non-profit, at a government agency, at a union, or a community group, this is the time to help spread the word to your members, to your employees. Also, please come to PSLF.nyc. Reach out to us. Contact us and we're going to give you a toolkit.

We're going to give you samples, social media posts, blank emails that you can send your staff. 20% to 30% of the staff at every government agency and non-profit in our city is carrying student loans. This is an opportunity to help our employees, our members get millions and millions of dollars coming to them. We're also calling for leadership to reach out, get some free tools from us, and spread the word among everyone in your network.

Brigid Bergen: Deputy Mayor Wright, it sounds like that is exactly what the city is trying to do to scream this information out to the city workforce, is that correct?

Deputy Mayor Sheena Wright: Absolutely. We've sent out emails, webinars that we've hosted. The mayor himself did a video. We've got a public service campaign that's happening for the general public as well. There are 250,000 New Yorkers that qualify for this. As Rich said, almost $10 billion is right there on the table. We want everyone to know about it, to get it done, and we want to make sure that the help is there and that people can access the help to get what they need.

Brigid Bergen: Deputy Mayor, since you're here and I know we have to wrap this up, I just wanted to ask you one quick question on another topic. The New York Times reported yesterday on that new think tank that's developing big ideas for the Adams administration. As the person who chaired his transition, how do you plan to work with this new Five Borough Institute? Should anybody read this as a sense that this administration lacks for big policy ideas?

Deputy Mayor Sheena Wright: Well, absolutely not. This administration coming in the door had and has a very clear agenda and has been executing on that agenda extremely successfully. We've got the first expansion of the Earned Income Tax Credit in decades, once-in-a-generation priority around public housing, and some of the policy changes there, education, public safety. In every area, we've been very, very focused on the core issues that impact New Yorkers.

We've got top experts, who are not only policymakers but practitioners and people with lived experience and leadership across the administration. Really, really kind of an A-team and have been clear about the vision and have been executing. We appreciate other stakeholders and we work very closely in there. There are many think tanks. I was just at the Center for an Urban Future yesterday and they had a conference. The Manhattan Institute. They're wonderful leaders and think tanks in the city. This will be another. We will look forward to working in partnership with them as we do with the other think tanks.

Brigid Bergen: Well, we're going to have to leave it there with Rich Leimsider, founder and campaign director for PSLF.nyc, a non-profit organization promoting applications to the PSLF waiver program, and, of course, Sheena Wright, deputy mayor of strategic initiatives for the city of New York. Rich, Deputy Mayor, thank you so much for joining us.

Deputy Mayor Sheena Wright: Thank you, Brigid.

Rich Leimsider: Thank you so much, Brigid, and thanks, Deputy Mayor.

Copyright © 2022 New York Public Radio. All rights reserved. Visit our website terms of use at www.wnyc.org for further information.

New York Public Radio transcripts are created on a rush deadline, often by contractors. This text may not be in its final form and may be updated or revised in the future. Accuracy and availability may vary. The authoritative record of New York Public Radio’s programming is the audio record.